An Unbiased View of Feie Calculator

Table of ContentsWhat Does Feie Calculator Mean?The Greatest Guide To Feie CalculatorFeie Calculator Can Be Fun For EveryoneFeie Calculator - The FactsNot known Factual Statements About Feie Calculator

He marketed his U.S. home to establish his intent to live abroad completely and applied for a Mexican residency visa with his better half to help accomplish the Bona Fide Residency Test. Neil directs out that buying building abroad can be challenging without very first experiencing the area."It's something that individuals need to be really attentive about," he states, and recommends deportees to be careful of common errors, such as overstaying in the U.S.

Neil is careful to stress to Anxiety tax united state that "I'm not conducting any performing in Organization. The U.S. is one of the few countries that taxes its people regardless of where they live, indicating that even if a deportee has no revenue from United state

tax returnTax obligation "The Foreign Tax Credit score enables individuals functioning in high-tax nations like the UK to counter their U.S. tax obligation by the amount they have actually already paid in taxes abroad," says Lewis.

Feie Calculator Things To Know Before You Buy

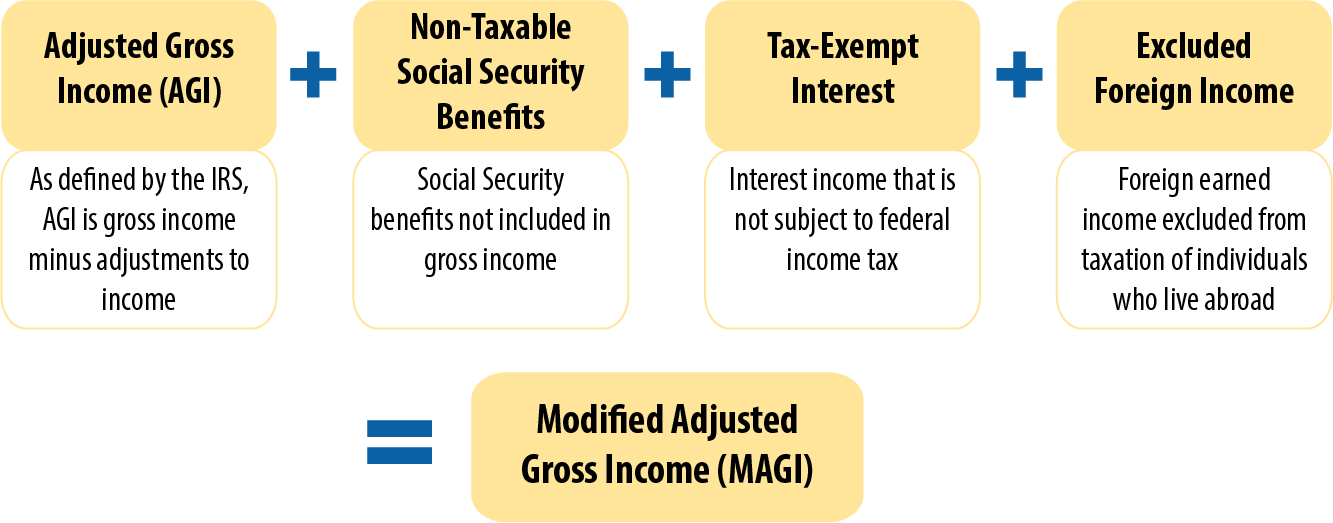

Below are several of one of the most often asked questions concerning the FEIE and various other exclusions The Foreign Earned Income Exemption (FEIE) enables united state taxpayers to leave out approximately $130,000 of foreign-earned earnings from government earnings tax, minimizing their united state tax liability. To get approved for FEIE, you need to fulfill either the Physical Visibility Test (330 days abroad) or the Authentic Residence Examination (verify your primary house in a foreign nation for a whole tax year).

The Physical Presence Test likewise needs U.S (American Expats). taxpayers to have both a foreign revenue and see post a foreign tax home.

How Feie Calculator can Save You Time, Stress, and Money.

An income tax obligation treaty between the united state and an additional nation can help protect against dual tax. While the Foreign Earned Earnings Exclusion minimizes gross income, a treaty might give additional advantages for eligible taxpayers abroad. FBAR (Foreign Financial Institution Account Report) is a required declare U.S. citizens with over $10,000 in international monetary accounts.

Eligibility for FEIE depends on conference specific residency or physical presence examinations. He has over thirty years of experience and now specializes in CFO services, equity settlement, copyright taxes, cannabis tax and separation related tax/financial preparation matters. He is an expat based in Mexico.

The foreign earned revenue exclusions, often described as the Sec. 911 exclusions, exclude tax obligation on earnings earned from functioning abroad. The exclusions comprise 2 parts - an earnings exclusion and a housing exemption. The following Frequently asked questions review the benefit of the exemptions including when both spouses are expats in a basic manner.

Excitement About Feie Calculator

The revenue exemption is currently indexed for inflation. The maximum annual earnings exemption is $130,000 for 2025. The tax obligation benefit excludes the revenue from tax obligation at bottom tax obligation prices. Previously, the exclusions "came off the top" minimizing revenue subject to tax obligation at the leading tax prices. The exclusions might or may not reduce revenue utilized for other purposes, such as individual retirement account limitations, child debts, individual exemptions, etc.

These exclusions do not spare the incomes from United States tax but merely supply a tax reduction. Keep in mind that a bachelor working abroad for all of 2025 that gained about $145,000 with no various other earnings will have gross income reduced to absolutely no - efficiently the very same solution as being "free of tax." The exemptions are calculated on a day-to-day basis.

Comments on “All about Feie Calculator”